FROM- Planet Gore

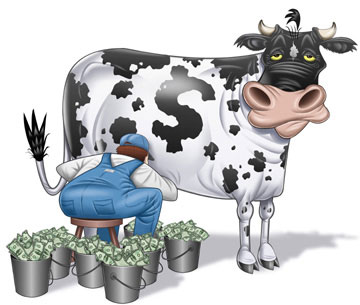

For TVA, Nuclear Is a Cash Cow

One of the biggest raps against nuclear power is that it can’t make money and requires huge subsidies from the federal government.

Tell that to the Tennessee Valley Authority (TVA). Exactly two years ago, the country’s largest public utility restarted Brown’s Ferry Unit 1 — a 1,100-megawatt reactor originally damaged in a 1976 fire that is generally regarded as the nation’s second worst nuclear accident. TVA spent $1.8 billion on the renovation and expected to pay off the construction debt in ten years.

Now it is finding the reactor may pay for itself in three years. Like most other reactors in the country, Brown’s Ferry is now making close to $2 million a day. “Once you get these things up and running, the operating expenses are minimal,” says David Blee, executive director of the U.S. Nuclear Infrastructure Council. “Once you pay off the construction debt, you’re sitting on a cash machine that may keep ringing up profits for another 60 years.”

Reactors have huge startup costs, of that there is no doubt. Current estimates are that plants on the drawing boards may take $8 to $10 billion to complete — more than the net worth of many utilities. But these costs are deceptive. Wind and solar installations actually cost more, since you need dozens of square miles of real estate for wind farms and sprawling solar collectors to get the same output. The advantage of wind and solar is that they don’t have to go through five years of licensing procedures at the Nuclear Regulatory Commission. Utilities and merchant companies must now spend $100 million just to get their applications before the NRC. (All costs of the procedure are born by the applicants.) But once construction is complete, reactors have absorbed 75 percent of their lifetime expenditures. Fuel and operating costs make up only 25 percent of total costs, as opposed to 70 percent for coal and 90 percent for natural gas, the other two sources of base-load power.

Here’s another interesting statistic. Natural gas plants now make up 39 percent of America’s total generating capacity but produce only 20 percent of our electricity. Nuclear, on the other hand, makes up 10 percent of our capacity but generates the same 20 percent. That’s because reactors are up-and-running 90 percent of the time while natural gas plants operate at only 20 percent capacity. The reason? Natural gas is so expensive that plants only run as a last resort.

Yet that last resort will be expanding under Waxman-Markey. One of the overlooked aspects of the Obama Energy Tax’s “renewable portfolio mandate” is that the all-out promotion of wind and solar actually means an all-out commitment to natural gas. Wind and solar generators can quit at any time so they must be paired with natural gas turbines, which are essentially jet engines bolted to the ground. Because they do not boil water, gas turbines can be started and accelerated at a moment’s notice to follow wind-and-solar’s vagaries. Unfortunately, it’s also among the most wasteful and expensive ways to generate electricity, which means prices will be increasing.

So here’s another telling statistic. Spain jumped into renewable energy with both feet in 2004 and has found electrical costs climbing 30 percent in five short years. In the Universidad Rey Juan Carlos study that Chris Horner has discussed frequently in this space, three scholars found that the creation of 47,000 “green jobs” in the wind, solar, and mini-hydroelectric industries had been more than offset by the loss of 110,000 jobs in major energy-consuming industries such as metallurgy, cement, and food processing. Several major manufacturers have relocated new plants in — guess where? — France, to take advantage of cheap nuclear electricity. Acerinox, the world’s second-largest manufacturer of stainless steel, has warned the Spanish government that it too will be disinvesting unless barriers to new nuclear construction are removed.

So get ready for higher electricity prices if the Waxman-Markey’s “renewable portfolio standard” of 17 percent by 2020 makes it through Congress. And get ready to see America’s already gutted manufacturing sector further disemboweled.

More...

For TVA, Nuclear Is a Cash Cow

One of the biggest raps against nuclear power is that it can’t make money and requires huge subsidies from the federal government.

Tell that to the Tennessee Valley Authority (TVA). Exactly two years ago, the country’s largest public utility restarted Brown’s Ferry Unit 1 — a 1,100-megawatt reactor originally damaged in a 1976 fire that is generally regarded as the nation’s second worst nuclear accident. TVA spent $1.8 billion on the renovation and expected to pay off the construction debt in ten years.

Now it is finding the reactor may pay for itself in three years. Like most other reactors in the country, Brown’s Ferry is now making close to $2 million a day. “Once you get these things up and running, the operating expenses are minimal,” says David Blee, executive director of the U.S. Nuclear Infrastructure Council. “Once you pay off the construction debt, you’re sitting on a cash machine that may keep ringing up profits for another 60 years.”

Reactors have huge startup costs, of that there is no doubt. Current estimates are that plants on the drawing boards may take $8 to $10 billion to complete — more than the net worth of many utilities. But these costs are deceptive. Wind and solar installations actually cost more, since you need dozens of square miles of real estate for wind farms and sprawling solar collectors to get the same output. The advantage of wind and solar is that they don’t have to go through five years of licensing procedures at the Nuclear Regulatory Commission. Utilities and merchant companies must now spend $100 million just to get their applications before the NRC. (All costs of the procedure are born by the applicants.) But once construction is complete, reactors have absorbed 75 percent of their lifetime expenditures. Fuel and operating costs make up only 25 percent of total costs, as opposed to 70 percent for coal and 90 percent for natural gas, the other two sources of base-load power.

Here’s another interesting statistic. Natural gas plants now make up 39 percent of America’s total generating capacity but produce only 20 percent of our electricity. Nuclear, on the other hand, makes up 10 percent of our capacity but generates the same 20 percent. That’s because reactors are up-and-running 90 percent of the time while natural gas plants operate at only 20 percent capacity. The reason? Natural gas is so expensive that plants only run as a last resort.

Yet that last resort will be expanding under Waxman-Markey. One of the overlooked aspects of the Obama Energy Tax’s “renewable portfolio mandate” is that the all-out promotion of wind and solar actually means an all-out commitment to natural gas. Wind and solar generators can quit at any time so they must be paired with natural gas turbines, which are essentially jet engines bolted to the ground. Because they do not boil water, gas turbines can be started and accelerated at a moment’s notice to follow wind-and-solar’s vagaries. Unfortunately, it’s also among the most wasteful and expensive ways to generate electricity, which means prices will be increasing.

So here’s another telling statistic. Spain jumped into renewable energy with both feet in 2004 and has found electrical costs climbing 30 percent in five short years. In the Universidad Rey Juan Carlos study that Chris Horner has discussed frequently in this space, three scholars found that the creation of 47,000 “green jobs” in the wind, solar, and mini-hydroelectric industries had been more than offset by the loss of 110,000 jobs in major energy-consuming industries such as metallurgy, cement, and food processing. Several major manufacturers have relocated new plants in — guess where? — France, to take advantage of cheap nuclear electricity. Acerinox, the world’s second-largest manufacturer of stainless steel, has warned the Spanish government that it too will be disinvesting unless barriers to new nuclear construction are removed.

So get ready for higher electricity prices if the Waxman-Markey’s “renewable portfolio standard” of 17 percent by 2020 makes it through Congress. And get ready to see America’s already gutted manufacturing sector further disemboweled.

More...

No comments:

Post a Comment